Creating A Legacy For Your Core

Leaving a Legacy is a Choice

A choice of action or inaction. Like death and taxes, leaving a legacy is an area in life where you really don’t have a choice. As a parent, you will pass on an inheritance of some kind to your kids and grandkids. A legacy of assets through savings, retirement, life insurance or a legacy of debt by the absence of these financial assets. Unfortunately, too many leave a legacy of debt by not planning ahead and either saving or investing to accumulate a legacy to leave behind or purchasing life insurance that will create an instant legacy upon their death.

Advisors of Integrity

Creating a legacy starts with the help of an advisor with integrity. Insurance is a tough world to navigate, and many agencies push solutions that might not be the best fit for you, but fill their pockets. At Core Integrity Financial our goal is to find the best solution for the legacy you want to leave behind to your family. We offer many solutions to help our clients solve the need of legacy protection or provide a solution for asset accumulation. At CIF our team is ready to help you create your legacy today!

Too Many Families Live With Financial Insecurity

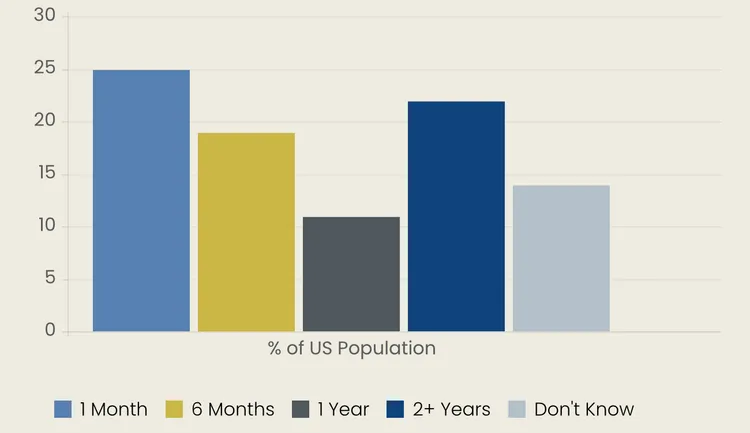

How long would it be before your household would feel the

financial impact if the primary wage earner were to pass away?

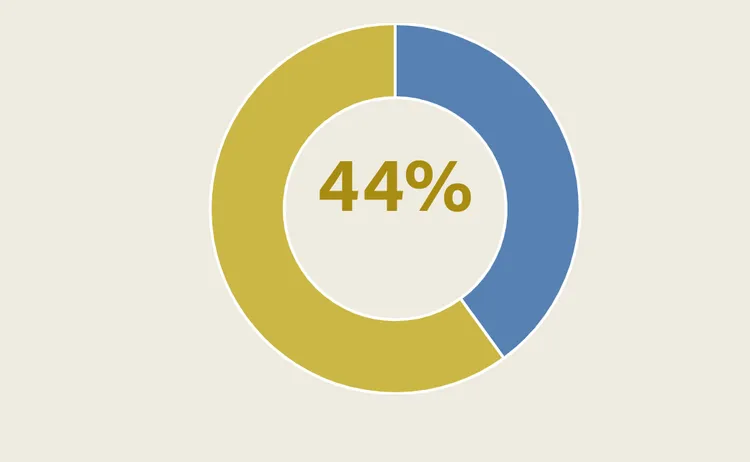

44% of U.S. households would

experience financial hardship

within six months.

©2022 LL Global, Inc.

888-929-CORE

Mailing Address:

14109 Brandywine Rd

Unit 126

Brandywine, MD 20613

Our A Rated Carriers

CIF values our clients’ needs and offers products from only top-rated companies. From family coverage, mortgage protection, final expense, IUL insurance products to fixed rate indexed annuities, we are confident that we can propose legacy solutions from a long list of the top-rated carriers that will meet our clients needs.