Choosing The Right Life Insurance Matters

Life insurance is the transfer of risk. While the other insurance coverages (auto, health, home, etc) may never be claimed, it is inevitable that life insurance will be needed. Death is often tragic, sad and full of grief, life insurance can’t not take away grief but it can alleviate the financial burdens and allow your loved ones the space and time they need to life without fear of losing their basic necessities and comfort of the life style you provided for them.

Life Insurance and the legacy you want to leave behind is unique to you and your core. There is no one sizes fits all plan so it is important to meet with an advisor you trust to help you plan your legacy with integrity.

We would love to help you get started on planning your legacy today!

Term Life

A term life policy is a contract between you and an insurance company for a defined period, typically between 10 and 30 years.

During that term, you promise to pay a premium each month.

In return, the company promises to pay a specific amount of money – a death benefit – if you pass away during the term.

The death benefit is paid to the beneficiaries named in your policy – typically one or more members of your family.

Many policies are level term – your premium payments stay the same for the length of the term.

The death benefit is tax-free (unless paid for with pre-tax money).

When the term expires, so does your life insurance protection. You can choose to do without or get another policy.

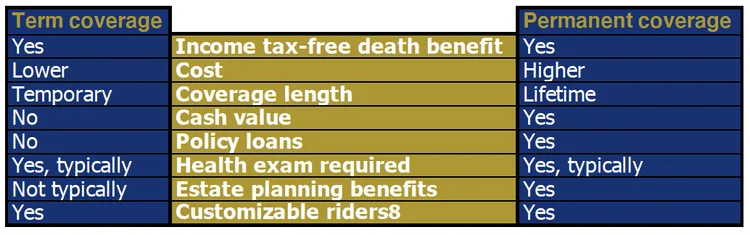

Pros and Cons: Term vs Permanent Life Insurance

Permanent Life

Permanent life insurance policies provide lifelong coverage -- even if you live to 100, the policy will pay a benefit as long as premiums are paid.

Permanent policies have another important feature: they build cash value.

Premium dollars can contribute to a policy’s cash account while growing – tax-deferred – and can be used while you're still alive. Over time the cash account can grow into a sizable asset that can be borrowed against with tax advantages, used to pay premiums, or even surrendered for cash to help fund your retirement.

Legacy is not what you are doing for yourself, it’s what you are leaving for the next generation.

Two Categories of Permanent Life Insurance:

Whole Life: Fixed premiums, guaranteed never to rise.

Universal Life. No fixed premiums, more flexibility on when you make payments.

Whole life insurance offers more stability while Universal life insurance offers more flexibility.

Whole Life

Whole life insurance is one of the oldest forms of life insurance.

Whole life insurance policies are intended to cover you for as long as you live. The policies have guaranteed premiums, guaranteed cash values and guaranteed death benefits. Some often offer “living benefits” such as terminal illness, chronic illness and critical illness benefits that can be accessed by the insured while they are alive. The amount used is taken from the value of the death benefit.

Whole life insurance policies can include a limited payment-period option. These policies will have a higher premium but you’ll pay for a shorter time.

Types of Universal Life

There are different types of Universal Life Insurance policies and each with a specific purpose, they are Guaranteed Universal Life, Indexed Universal Life and Variable Universal Life.

Guaranteed Universal life Insurance (GUL)

Guaranteed Universal life Insurance (GUL) provides a guaranteed death benefit amount to your beneficiaries as long as the premiums are paid on time and kept up to date. The premiums are level and there is very little cash value growth.

Variable Life Insurance (VUL)

Variable Life Insurance (VUL) provides a combination of life insurance and the "cash value" which functions similar to investments which are risk related in funds such as stocks, bonds, equity funds, and money market funds. Because of the "cash value" investment classification VULs are regulated under the federal securities laws, the policy owner owns the risk of the policy which can be both gains and losses.

Indexed Universal Life Insurance (IUL)

Indexed Universal Life Insurance (IUL) provides death benefit protection and "cash value" growth against based on an index such as the S&P 500. The "cash value" of the IUL typically has a guarantee and non-guarantee options, they vary based on the insurers and their product types.

Beginning to create a legacy for your core

is only one step away!

888-929-CORE

Mailing Address:

14109 Brandywine Rd

Unit 126

Brandywine, MD 20613

Our A Rated Carriers

CIF values our clients’ needs and offers products from only top-rated companies. From family coverage, mortgage protection, final expense, IUL insurance products to fixed rate indexed annuities, we are confident that we can propose legacy solutions from a long list of the top-rated carriers that will meet our clients needs.